How States Around the World Are Crafting Markets for Green Hydrogen

22.11.2024

Green hydrogen will play an essential role in the decarbonization of hard-to-abate industries, including the steel, cement, fertilizer, shipping and aviation sectors. Governments worldwide are developing policies with the aim of shaping green hydrogen markets. As part of its work on the HYPAT project, the research group on Geopolitics of Energy and Industrial Transformation has developed a unique database on green hydrogen policies that will enable researchers to track political trends and governments’ priorities in this early stage of market development.

The International Hydrogen Policy Tracker compiles and systematizes data on the policy and regulatory landscape in the hydrogen sector in major frontrunner countries within the global hydrogen economy. Developed by RIFS researchers, the database covers eight major frontrunner countries (Australia, Canada, China, Germany, Japan, Spain, UK, US) and the European Union, and offers a comprehensive overview of relevant policy initiatives. The researchers collected and coded information on instrument types as well as sectors and technologies receiving policy support across more than 100 categories (see codebook). The Policy Tracker also features a tool that facilitates the systematic characterization and comparison of policy instruments in major frontrunner countries. In the following, we present some of initial insights.

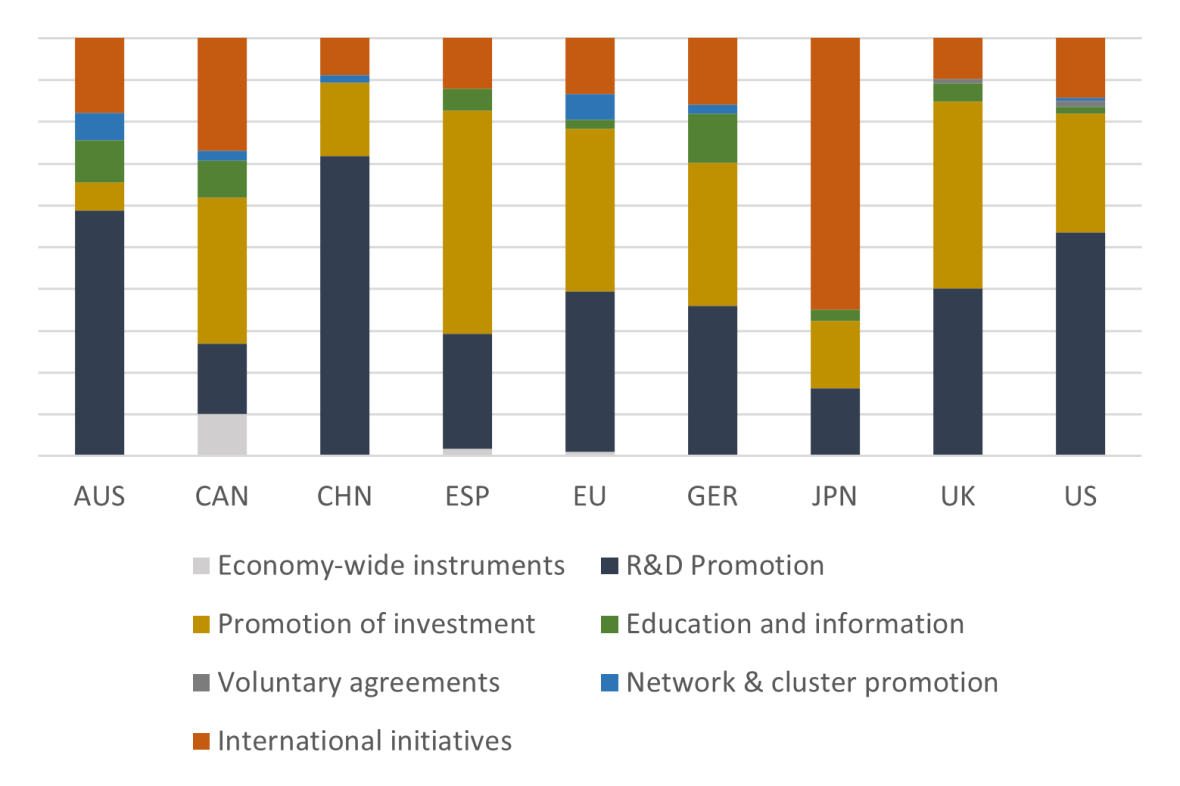

The state plays a crucial role in the initial phase of hydrogen market and technology development by bringing down costs, supporting investment in supply- and demand-side technologies, and fostering demand by reducing uncertainty. Countries use different policy instruments to craft green hydrogen markets. In most countries, the largest number of policy initiatives are aimed at fostering innovation (see Figure 1). They are typically part of large-scale R&D support schemes. In the EU for instance, most research projects related to hydrogen are funded through Horizon Europe. The UK has designated more than £14 million to hydrogen research under the Innovate UK programme. The USA created the Hydrogen Shot Initiative, which is exclusively designed to fund hydrogen research. Generally, most policy support in this area is provided in the form of research grants. Other instruments promote private investment, stakeholder education, firm clusters and international partnerships (see Figure 1).

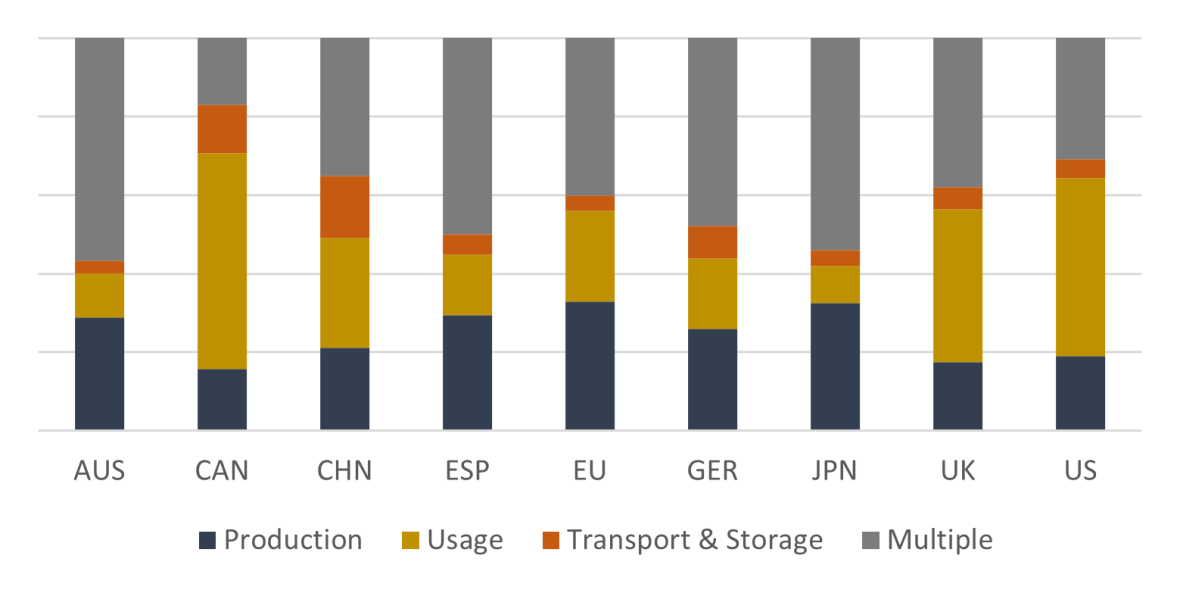

Supply-side policies support either the domestic or foreign production of green hydrogen. While the USA and (to a lesser degree) China use tax credits, the EU has set up an auction mechanism to incentivize green hydrogen production. Those countries that expect to have a high demand and low potential for production additionally invest in safeguarding supply from abroad. Germany’s H2Global programme provides subsidies for production facilities in partner countries, for example. The EU does not have a similar programme at present but is providing funding under its Global Gateway initiative and has delegated the European Investment Bank to de-risk clean hydrogen production abroad. Other countries such as the USA and the UK rely more on domestic supply creation. The countries with the highest share of policies exclusively devoted to production are Australia, Spain, Japan and the EU (see Figure 2).

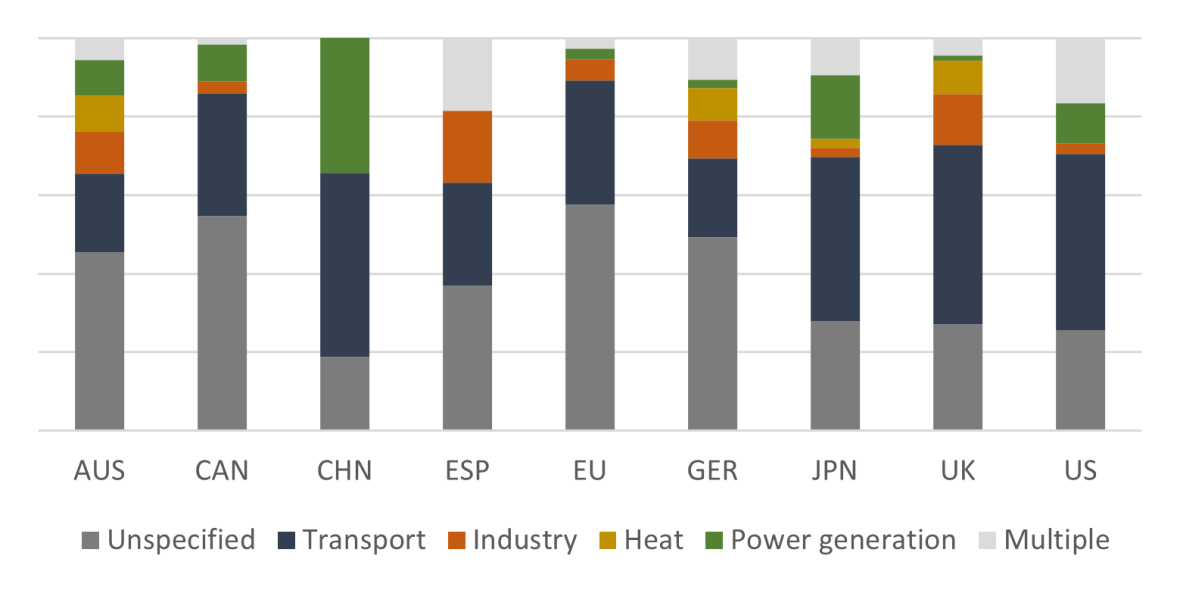

To create sufficient demand for green hydrogen, governments also support its use in different sectors. Carbon Contracts for Difference (CCfD) are a popular instrument to incentivize decarbonization in the industrial sector. They are already applied in Germany and the UK and are planned in the EU. Other demand-side programmes typically involve funding or tax credits. The European Commission has adopted binding sectoral targets for the uptake of clean hydrogen: 42% of hydrogen used in industry must be renewable by 2030. In the transport sector, at least 1% of the renewable energy supplied must come from sustainable fuels such as hydrogen. North America and the UK account for the largest share of policies related to demand promotion in our data collection (see Figure 2). Across all countries included in the database, the transport sector accounts for the largest share of policies aimed at promoting hydrogen usage (see Figure 3).

The countries included in the database are also building hydrogen infrastructure to connect producers and consumers. A central element of the US hydrogen infrastructure strategy is the construction of Regional Clean Hydrogen Hubs. The Biden Administration has designated $7 billion to promote these clusters. In the EU, cross-border hydrogen infrastructure projects can apply for funding as Important Projects of Common European Interest (IPCEIs). So far, three projects have been approved by the Commission, with the explicit aim of building a European hydrogen network. Chinese state-owned enterprises are pursuing the large-scale deployment of hydrogen refuelling stations and the construction of a pipeline network, including a long-distance pipeline connecting Eastern and Western China.

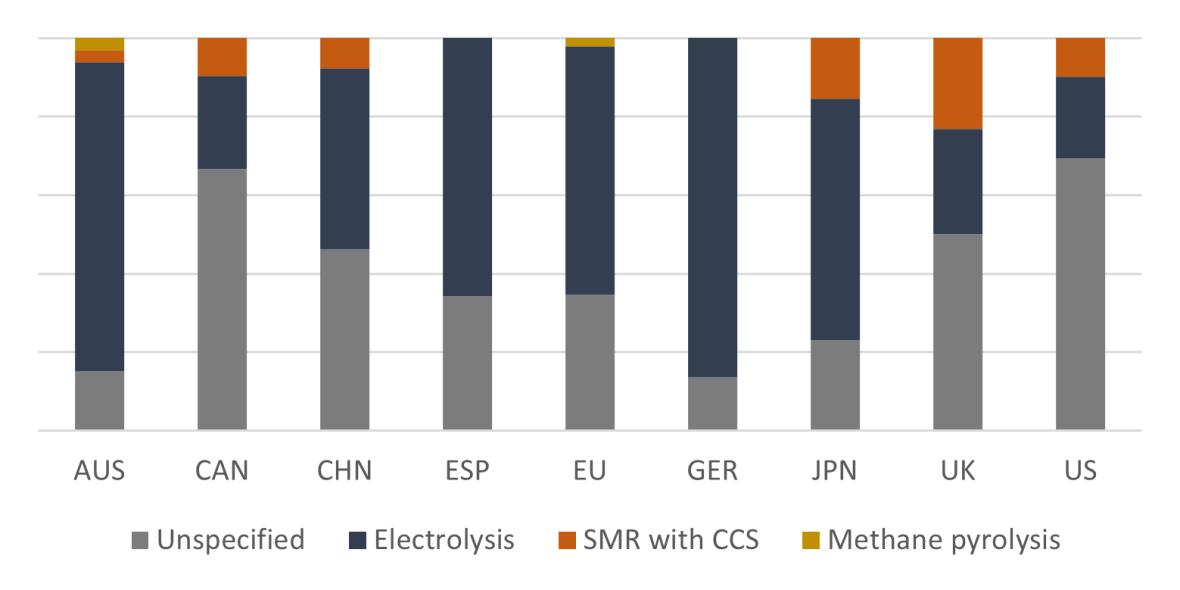

The development and adoption of reliable sustainability criteria is also important for creating green hydrogen markets. The EU’s Renewable Energy Directive (2023) requires that green hydrogen production adhere to three principles to be recognized as renewable: additionality (new renewable energy capacities have to be added to power production), temporal correlation (hydrogen production has to take place during time periods of renewable power generation) and geographical correlation (renewable power generation has to be located in the same bidding zone as the electrolyzer). Governments are also cooperating to develop and harmonize standards. While the EU and member states like Germany and Spain have prioritized green hydrogen, other countries, such as Canada, Japan, the UK or the US, have approaches that are less technology-specific and also support the production and use of blue hydrogen (e.g. through steam methane reforming (SMR) combined with carbon capture and storage) (see Figure 4).

While trade-related policy initiatives remain rare, some countries are seeking to protect their domestic markets by imposing local content requirements (LCR) and carbon border adjustment mechanisms (CBAM). Tax credits provided under the Inflation Reduction Act for projects located in communities disadvantaged by the energy transition are an example of LCR deployment. In the EU and the UK, hydrogen will be covered by planned CBAMs. While the countries included in the database have signed up to numerous cooperation agreements, these statements often only express vague intentions. Countries such as Japan and Germany, which will rely on future imports, are especially keen to forge international hydrogen partnerships (see Figure 1). The EU has also entered into multiple partnerships. The strongest signal on integration, however, has come from the USA, Canada, and Mexico, which have agreed to create a “North American clean hydrogen market”. On the other side of the Pacific, China intends to pursue hydrogen cooperation along its Belt and Road Initiative.