The EU and Azerbaijan as Energy Partners: Short-Term Benefits, Uncertain Future

11.11.2024

Azerbaijan has strengthened its energy ties with the EU since 2022, ramping up gas deliveries and articulating ambitions to export renewable energy and green hydrogen to Europe in the future. However, the EU’s shrinking gas demand and Azerbaijan’s lack of a genuine decarbonization strategy cast uncertainty on the long-term prospects of this partnership – all the more so given the EU’s persistent criticism of political repression and human rights violations in the South Caucasus republic.

Expanding energy ties

Azerbaijan (population 10.3 million), which is the host of this year’s global climate summit COP29, is the epitome of a country experiencing carbon lock-in. Oil and gas production contributes roughly half of the South Caucasus republic’s GDP and half of all its national budget revenues, as well as more than 90 percent of its export earnings. The largest share of these exports goes to the European Union (EU) and is transported over pipelines running through Georgia and Turkey to Greece, Albania and Italy (Azerbaijan does not produce liquefied natural gas, LNG). With an annual production total of 48.7 billion cubic meters (bcm) of natural gas and 30.2 million tons of crude oil (2023 figures), Azerbaijan may be a smaller-sized producer in global comparison, but its importance for the EU has been growing. It is now the fourth-largest supplier of piped gas to the EU with a share of 7 percent, behind Norway, Algeria and Russia. Of the EU’s total gas imports, Azerbaijan’s share stands at 3 percent.

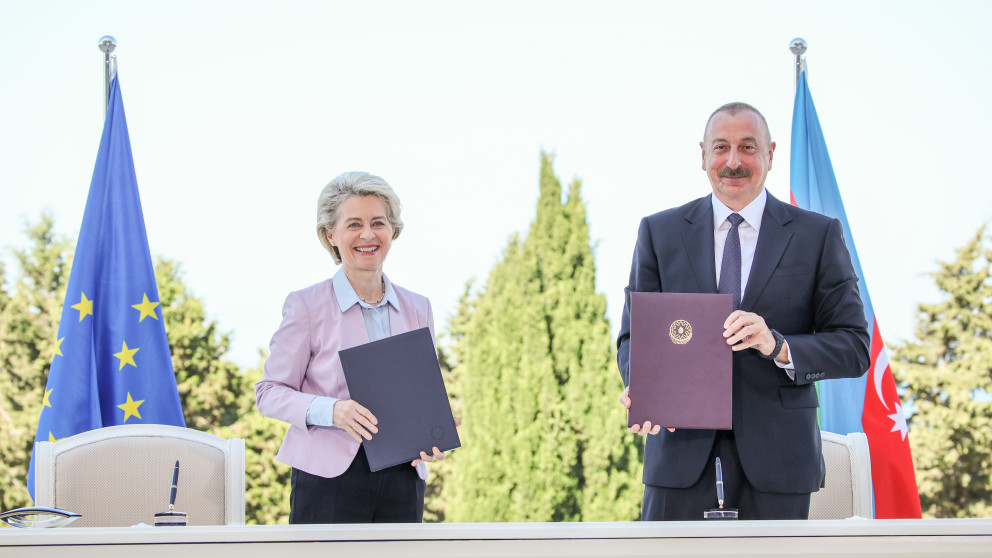

The new geopolitical era ushered in by Russia’s full-scale invasion of Ukraine in 2022 has presented opportunities to Azerbaijan. As the EU scrambled to secure non-Russian gas supplies, Azerbaijan was quick to step in. In July 2022, European Commission President Ursula von der Leyen traveled to Baku to sign the EU-Azerbaijan Memorandum of Understanding on a Strategic Partnership in the Field of Energy. As part of the agreement, Azerbaijan pledged to more than double its gas supplies to Europe to 20 bcm annually by 2027. The EU’s decision to upgrade these ties has been controversial from the very beginning due to Azerbaijan’s worrying track record of political repression and human rights violations. In October 2024, the European Parliament passed a highly critical (although non-binding) resolution calling on the EU to end its reliance on gas exports from the country and suspend the 2022 Memorandum.

So far, however, political expediency has trumped other concerns. By the end of 2022, Azerbaijan was able to deliver 11.4 bcm to the EU (up from 8.1 bcm in 2021), followed by 11.8 bcm in 2023. Thanks to high gas prices, Azerbaijan’s export earnings from gas surged from USD 5.56 billion in 2021 to USD 14.99 billion in 2022 and USD 13.68 billion in 2023, surpassing revenues from oil exports for the first time in the country’s history. Azerbaijan has also expanded the geography of its exports to Europe. Romania began importing Azeri gas in 2023, followed by Hungary, Slovenia and Croatia in 2024, joining Italy (the largest importer), Bulgaria and Greece. Slovakia has expressed its interest in Azeri gas deliveries as well, while Hungary’s state-owned power company MVM Group acquired a 5 percent stake in Azerbaijan’s major Shah Deniz gas field development project and a 4 percent stake in the South Caucasus Pipeline Company in August 2024.

Still, delivering on the highly ambitious 20 bcm pledge to the EU will be very challenging. On the one hand, Azerbaijan’s gas production has been growing: TotalEnergies and Azerbaijan’s state-owned oil and gas company SOCAR brought on stream the new Absheron gas field in 2023, while a BP-led consortium is developing newly discovered large gas reserves. On the other hand, much more investment is needed, both in new gas production capacity and in expanding the Southern Gas Corridor. Doing so has become increasingly difficult, as European and international financial institutions are reluctant to finance fossil fuel infrastructure. In addition, domestic demand has been rising fast as well. Alternative options to boost deliveries to the EU thus focus on freeing up gas from other sources. This can include shifting a share of exports away from large non-EU consumers (such as Turkey), lowering domestic gas consumption (e.g., by deploying more renewables in the gas-dominated power-generation sector) or covering a portion of domestic demand by importing cheaper gas from elsewhere. In fact, Azerbaijan did significantly increase imports of Russian (and Turkmen) gas in 2023 – thus indirectly undermining the rationale behind the EU’s ambition to phase out its dependence on Russia.

Finally, Azerbaijan is also likely to play an important role in deciding the fate of the so-called Ukrainian transit, that is, the continuing flow of Russian gas (ca. 15 bcm in 2023) through Ukraine to the EU. The transit is governed by the terms of Gazprom’s contract, which expires at the end of 2024, with Ukraine’s national oil and gas company, Naftogaz. Although the EU could in principle replace these volumes by importing more LNG, Hungary, Slovakia and Austria are interested in preserving the flows. One of the most feasible options would be to have Azerbaijan purchase Russian gas and send it to Europe as legally relabeled “Azeri” gas. Yet, the details of any future arrangement remain highly contested.

Azerbaijan’s expanding gas trade with the EU may be lucrative but it carries risks. Not only does it expose the country to significant price volatility but, more fundamentally, it also lacks a clear future perspective. The EU’s natural gas demand has been declining since 2022 due to a combination of the drop in industrial consumption, efficiency gains and the faster deployment of renewables. The bloc’s stringent climate goals – including the 2050 net zero target and the currently discussed 90 percent greenhouse gas reduction target by 2040 – mean that Europe is expected to consume much less fossil gas in the future. In addition, EU law stipulates that new contracts for fossil fuel deliveries cannot extend beyond 2049. European companies have been reluctant to enter into long-term gas supply agreements with Azerbaijan, making it difficult to attract sufficient private investment into new gas production capacity. Finally, the EU is anticipating new LNG supplies from 2026 onward, mainly from Qatar, and it is far from certain how much gas Europe will actually need from Azerbaijan by the end of the decade.

Sluggish energy transition

Azerbaijan’s strategic partnership agreement with the EU, while mainly focusing on natural gas, also includes language on clean energy cooperation. When it comes to the energy transition, however, COP29’s host country has been a laggard. Azerbaijan’s climate policy is very unambitious: In the 2023 update of its Nationally Determined Contribution (NDC) under the Paris Agreement, Azerbaijan set the target of a mere 40 percent reduction in emissions by 2050, conditional on receiving international support. (By contrast, its hydrocarbon-rich peers Kazakhstan, Uzbekistan and Russia have all adopted net zero targets.) Azerbaijan was also late in launching solar and wind development. In 2022, natural gas held a 93 percent share of total electricity generation, while renewable energy – represented almost exclusively by hydropower – only provided 6 percent. Far from planning a fossil fuel phaseout, Azerbaijan, if anything, is intent on monetizing its hydrocarbon resources, especially gas. By 2033, it is expected to increase its gas production by a third, reaching 49 bcm (up from 37 bcm in 2024). Azerbaijan’s oil production, by contrast, has been steadily declining since 2010.

Nevertheless, Azerbaijan has put effort into burnishing its green credentials in three major ways: working to attract foreign investment into large-scale renewable energy development, including offshore wind; joining international efforts to combat methane emissions; and positioning itself as a key component of the future green Caspian hub, with ambitions to export green electricity and green hydrogen to Europe. While commendable, these initiatives are not yet rooted in a comprehensive decarbonization policy, and there are no state support instruments to promote the energy transition in industry or in the transport and residential sectors.

In the power-generation sector, Azerbaijan is aiming at a 30 percent share of renewable energy in the total installed power-generation capacity by 2030 – a target that appears to be within reach. (This is not to be confused with having 30 percent of electricity generated from renewable energy sources, which would be more challenging.) Aside from climate benefits, renewables could help free up additional volumes of natural gas for export, which would generate much higher revenues than in the domestic market. In 2023, Azerbaijan’s total installed power-generation capacity stood at 8.32 gigawatts (GW); this included 1.7 GW in renewable energy capacity (mostly represented by hydropower), thus already amounting to ca. 20 percent. On wind and solar, Azerbaijan has been closely cooperating with the leading Gulf companies, such as Masdar of the United Arab Emirates (UAE) and Saudi Arabia’s ACWA Power, which have been actively expanding their presence in Central Asia and the Caucasus in recent years. In October 2023, Masdar launched a 230 MW solar farm in Garadagh near Baku, the largest in the Caspian region. The UAE-based company has also inked a deal with Azerbaijan’s SOCAR to construct three more large-scale wind and solar facilities with a combined installed capacity of 1 GW: two giant solar farms in Bilasuvar (445 megawatts, MW) and Neftchala (315 MW), as well as a 240 MW Absheron-Garadagh wind farm. Saudi Arabia’s ACWA Power is in charge of constructing a 230 MW wind farm in Khizi on the Absheron peninsula. These projects alone, if completed on time, would put Azerbaijan well on track toward reaching the 30 percent target. Azerbaijan is also the only country in the region to actively consider offshore wind development. The government’s 2022 Offshore Wind Roadmap, developed with the assistance of the International Finance Corporation (IFC), outlines two scenarios envisioning the deployment of 1.5 GW to 7.2 GW of offshore wind capacity by 2040.

A special place in Azerbaijan’s energy transition plans is reserved for the territories recaptured from Armenian control as a result of two large-scale military offensives in 2020 and 2023. Azerbaijan’s military takeover has led to the flight of almost the entire ethnic Armenian population and spelled the end of the breakaway Nagorno-Karabakh Republic (Artsakh), which existed between 1991 and 2023 but remained unrecognized by the international community. In its 2023 NDC update, Azerbaijan announced intentions to make the territories (now formally called the Karabakh and East Zangezur Economic Regions) a “net zero emission zone” by 2050 as part of the major reconstruction effort, with hydropower playing the leading role. Although the repopulation has proceeded very slowly, Azerbaijan has already launched the construction of several of the 28 planned hydropower plants in both regions. There are also plans for solar and wind power plants, including a 240 MW solar farm to be built by BP in the Jabrayil district (East Zangezur Region). The facility will help decarbonize the operations of BP’s Sangachal oil terminal on the Caspian Sea. There are even tentative plans for renewable hydrogen production for export to the EU.

Tackling methane emissions along the gas value chain is another focus area explicitly mentioned in the 2022 EU-Azerbaijan Memorandum of Understanding. The EU, the largest buyer of Azeri gas, has introduced much more stringent requirements as part of its newly adopted methane regulation. From 2028 onwards, European importers of oil, gas and coal will be required to report on the methane intensity of their imports, and starting in 2030, they will have to prove their compliance with a predetermined emissions threshold. In March 2024, Azerbaijan announced it would join the Global Methane Pledge, a joint initiative launched by the US and the EU in which participating countries voluntarily commit to reduce their methane emissions by 30 percent by 2030. Although Azerbaijan is not one of the most notorious emitters (such as Turkmenistan), its methane emissions have grown by 11 percent since 2018 due to the expansion of gas production in recent years. This means that adapting to the new requirements will necessitate serious efforts, yet no national methane strategy has been developed at the time of writing.

An energy bridge connecting the South Caucasus and the Caspian region with Europe

Due to its strategic location, Azerbaijan can play a role in transiting energy (whether fossil or green) from Central Asia to Europe. Kazakh oil is a case in point. A lion’s share of Kazakhstan’s oil exports is transported via the Caspian Pipeline Consortium (CPC) pipeline through Russian territory to the Black Sea port of Novorossiysk. Due to repeated disruptions, Kazakhstan has been looking for ways to diversify its oil export routes. In 2022, Azerbaijan’s SOCAR and Kazakhstan’s national oil and gas company, KazMunayGas, signed an agreement on the annual transit of 1.5 million tons of Kazakh oil through Azeri pipelines; this was expanded to 2.2 million tons in a follow-up agreement in March 2024.

Azerbaijan has also been touted as a potential transit country for Turkmen gas deliveries to Europe. The proposed subsea Trans-Caspian Pipeline has been under discussion since the 1990s, with little progress achieved. Nevertheless, the idea has received a new impetus lately, given the EU’s intent to phase out imports of Russian gas, Turkmenistan’s interest in diversifying export routes beyond Russia and China, and Turkey’s plans to become a gas hub for Europe. In May 2024, Azerbaijan and Turkey signed a cooperation agreement on bringing Central Asian gas to Europe via Azerbaijan. However, the impediments to these plans are still in place: Securing financing for a fossil gas pipeline would be complicated, and, more fundamentally, the EU’s demand for gas is expected to shrink.

It is not all about oil and gas, however. Looking ahead, Azerbaijan is envisioning itself as a key node in the future green energy corridor(s) connecting the South Caucasus, Central Asia and Europe. To this end, it has been stepping up engagement with its regional neighbors and interested EU member states. In December 2022, Azerbaijan, Georgia, Hungary and Romania signed an agreement on constructing a high-voltage Black Sea submarine transmission cable to bring renewable electricity from Azerbaijan’s (yet to be built) Caspian wind farms – as well as from Georgia, which has been playing an increasingly prominent role in the initiative – to Romania and Hungary. The project has received praise from the European Commission and a USD 35 million loan from the World Bank for preparatory activities, with more financing available. A feasibility study was completed in summer 2024 and provided encouraging results. At the same time, the scope of the challenge is enormous: The proposed 1,200 km cable would be the longest in the world and, due to its location in the Black Sea, would face serious security risks due to the ongoing armed hostilities between Russia and Ukraine. The economic rationale and the expected payback time also remain contested.

A related high-profile project for Azerbaijan is creating a Caspian green energy hub. In May 2024, Azerbaijan, Kazakhstan and Uzbekistan signed a Memorandum of Understanding on linking their power grids through a high-voltage transmission line on the Caspian seabed, with a view to enabling renewable electricity exports to Europe. An intergovernmental agreement on a tripartite strategic partnership in the area of green energy is expected to be signed at COP29 in Baku. In addition, there has been some discussion in Azerbaijan on the potential of exporting green or blue hydrogen to Europe, possibly through the retrofitted Southern Gas Corridor. Given the highly carbon-intensive nature of the participating countries’ economies, however, using green electricity and hydrogen for domestic decarbonization instead of exports would no doubt generate the biggest climate benefits.

Conclusion

In the past two years, Azerbaijan has significantly strengthened its energy ties with the EU, helping the bloc lower its dependence on Russian gas and earning Azerbaijan windfall revenues in the process. In absolute terms, however, Azerbaijan is an important but by no means an indispensable energy supplier for Europe. While Azerbaijan has been investing into expanding gas production for export, the shrinking gas demand in Europe means that it runs the risk of being left with stranded assets. Azerbaijan has also intensified efforts to develop large-scale renewable energy capacity and to position itself as a key node along the envisioned green energy corridors connecting the South Caucasus and the Caspian region to Europe. However, these plans are not rooted in a comprehensive energy transition policy domestically, and their economic rationale remains questionable. Finally, with its alarming human rights track record, Azerbaijan has been a controversial partner for the EU politically, and many voices – including in the European Parliament – have called for a critical reassessment of the relationship. Taken together, these factors cast uncertainty on the long-term prospects of Azerbaijan’s energy partnership with the EU.

This blog post was first published by the Heinrich Böll Stiftung on 5 November, 2024.